Average mortgage payment on 100k

Real estate 40 cities that could be poised for a housing crisis. Better long term option is put all your spare cash into an index fund which returns on average 88 over the long term.

Tallahassee Real Estate Market Update October 2020 Graphing Real Estate Marketing Tallahassee

3 Minimum to open is 100.

. And of course you can keep an eye on average mortgage rates to get a ballpark estimate of whats currently being offered. Mortgage buyer Freddie Mac reported Thursday that the 30-year rate fell to 513 from 522 last week. The minimum balance to open the certificate is 500.

2 days agoGPARENCY a commercial mortgage brokerage company that has averaged more than one new contract per day in the third quarter of 2022 -- including a recent 39 million mortgage closing an 83. The maximum mortgage value plus CMHC loan is capped at around 560000. The average cost of a tiny house is a reasonable 30000 60000 although they can cost as little as 8000 or up to 150000 depending on the amenities you choose to include.

Though paying a 20 down payment may not be required its still worth making a large down payment on your mortgage. Mortgage rates pulled back this week but economic uncertainty continues to keep price-struck buyers at bay. A mortgage fixed for five years will now charge 424 on average an increase from 264 in December 2021 The average rate on a ten-year fixed deal is now 420 up from 297 in December.

FREE The best writer. 1 Annual Percentage Yield APY. Get All The Features For Free.

The gov means its official. Here are several benefits to paying 20 down on your home loan. What are todays average interest rates for home equity loans.

Bank of America lauches zero-down mortgage for Black Latino borrowers. Scroll down the page for more detailed guidance on using this mortgage calculator and frequently asked. Select a loan term from the drop-down menu this is the number of years over which.

4 Annual Percentage Yield of 320 for a 19-Month Certificate. The calculator works immediately as you slide or input your gross monthly income monthly debts loan terms interest rate and down payment. Platinum 50K to 100K three-month combined average daily balance 50-100K.

Penalty for early withdrawal. About New York Mortgage Trust. For example on a 400000 resale home after deducting your 5 down payment 20000 and 5 incentive.

To use our mortgage calculator slide the adjusters to fit your financial situation. And I do not have a car payment or credit card debt. 2 Minimum to open is 500.

Yield on average interest earning assets. So that might mean that if you. Obtains better than average rates.

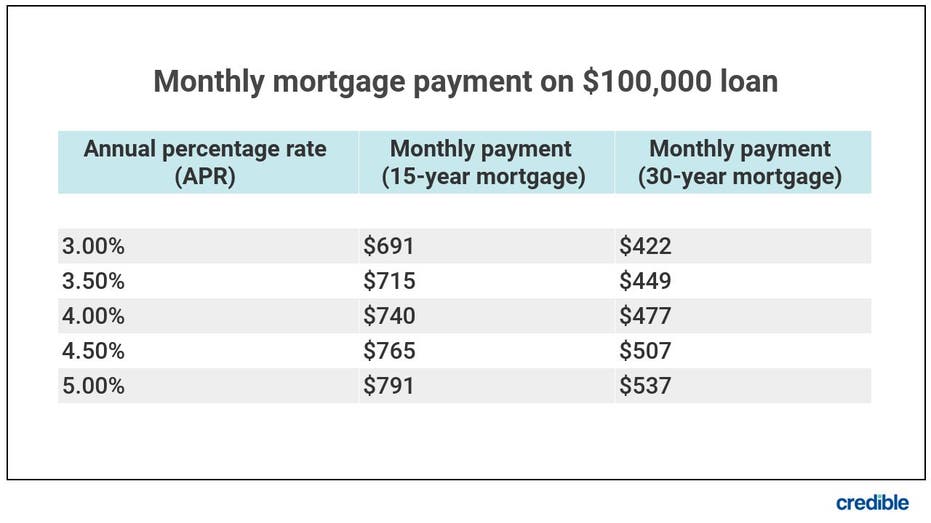

When is the. Rates persist within reach of record lows. For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 359 monthly payment.

House refurbishment cost by bedrooms. Average long-term US. Their monthly mortgage payment would be about 4100.

Federal government websites often end in gov or mil. Rates include an Active Rewards rate enhancement of 010. If PayPlan enrollment is not completed 10 days prior to loan closing or if the loan is a product.

The bank makes a lot more out having an extra 100k sitting in their coffers to place into investments. Before sharing sensitive information make sure youre on a federal government site. The average 30-year fixed-mortgage rate is 595 the average rate youll pay for a 15-year fixed mortgage is 519 percent and the average 51 ARM rate.

A new mortgage scheme was announced to help homebuyers with a 5 deposit get accepted for a mortgage. For example on a 100k property with a 95 mortgage the lender would not have a Government guarantee on the first 80k but the. And enroll in PayPlan our automatic payment service designating an eligible Bank of America checking or savings account at least 10 days prior to loan closing.

The default shown on our calculator is an average rate on the day you. 669 Interest income. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms.

In order to qualify for a land loan you will need a significant down payment and good credit score. Pay your mortgage at the minimum and use the index fund to balance the difference after the 30 years. Rate subject to change.

It can be challenging to get approved for these loans due to. One of the first questions you ask when you want to buy a home is how much house can I afford. The Maximum Mortgage Calculator uses your current financial situation to calculate the maximum monthly mortgage payment that you can afford.

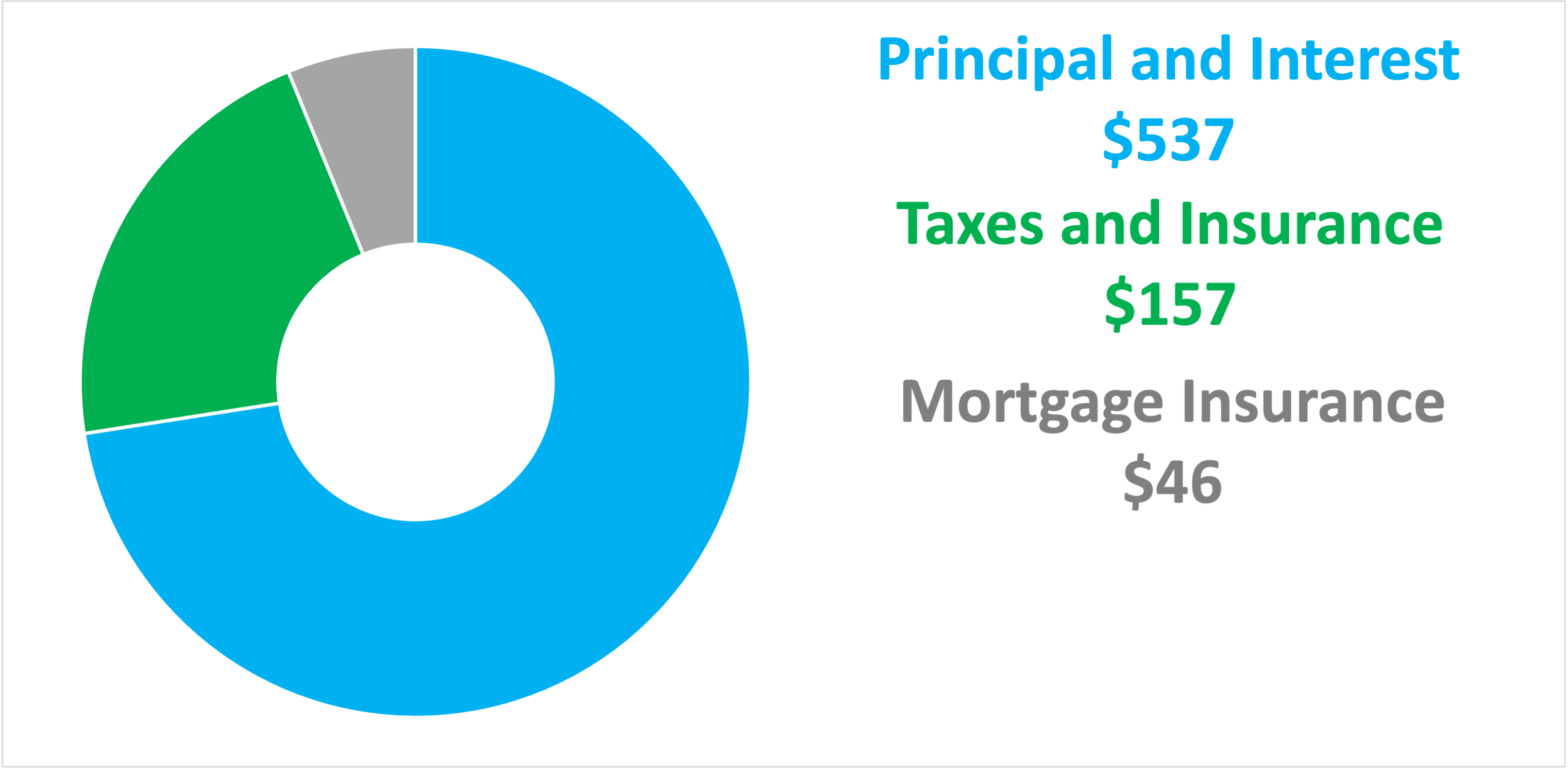

Mortgage lenders will qualify you by factoring in taxes and insurance not just your monthly mortgage payment. If it is a new home that qualifies for the full 10 incentive ie. The average rate on 15-year fixed-rate mortgages popular among those looking to refinance their homes inched.

40000 your mortgage amount falls to 340000 potentially saving you 228 per month mortgage. Mortgage rates came back down slightly this week after the key 30-year loan rate jumped nearly a quarter point last week. If the home is beyond repair the average cost to tear down and rebuild a house is 125000 to 450000 or 104 to 165 per square foot.

An example would be if you had 100000 in savings and used all of it to finance a 500000 property with a 2500 monthly mortgage payment when your net income is 3000 per month. You could potentially take out 100k cash and your new loan amount would be 300000. We offer the lowest prices per page in the industry with an average of 7 per page.

Approved but usually charged a higher rate. If you arent sure of this yet leave the default value as this is representative of the current market average. Expect to need at least 100K of income for a 1M home.

Paige Casey is suing retail chain for 100K but providing abortion options is part of her job a CVS spokesman said. The average cost to fully renovate a 3-bedroom house is 25000 to 100000 and between 40000 to 180000 to remodel a 4-bedroom home. These renovation costs range from.

Assuming you have a 20 down payment 20000 your total mortgage on a 100000 home would be 80000. In this MoneySavingExpert guide we cover how the new scheme will work and the eligibility criteria. A late fee of 5 of the payment amount limits apply and a returned check fee of 15.

With a 100000 salary you have a shot at. Those likely approved for credit. A 100K salary puts you in a good position to buy a home.

How Much A 100 000 Mortgage Will Cost You Credible

Pin On Dribbble Ui

100k Mortgage Mortgage On 100k Bundle

Here Is Your Opportunity Business Credit Agents Needed Nationwide Im Looking For Busin Credit Repair Business Credit Repair Companies Credit Repair Services

Dave Ramsey In Most Places Homes Cost A Lot More Than This Example But The Proportions On This Comparison Remain The Same A 15 Year Mortgage Is The Only Way To Go

How Much A 100 000 Mortgage Will Cost You Credible

Here S How Much A 100 000 Mortgage Will Cost You Fox Business

Tiny Houses All About Tiny Home Living The Tiny Life Home Ownership Homeowners Insurance Homeowner

The Best Homeowners Insurance Companies In Utah Reviews Farm House Living Room Real Estate Cool Rooms

Our Very First Home 2015 Homeownership Ca In 2022 Buying First Home First Home Buyer Dave Ramsey Baby Steps

What Is The Average Small Business Owner Salary In The U S Money Life Hacks How To Get Money Fundera

May S Mibor Snapshot Is In Sales Are Up Rates Are Low And Again Low Inventory Snapshots Real Estate Inventory

Here S How Much A 100 000 Mortgage Will Cost You Fox Business

Is A Real Estate Career Still A Good Choice In 2020 Real Estate Infographic Real Estate Career Real Estate School

The Average Condo Price Increase Toronto And Your Investment Investing Real Estate Investing Real Estate Tips

Pin On Real Estate Charts And Graphs

Who Has Student Loan Debt In America The Washington Post